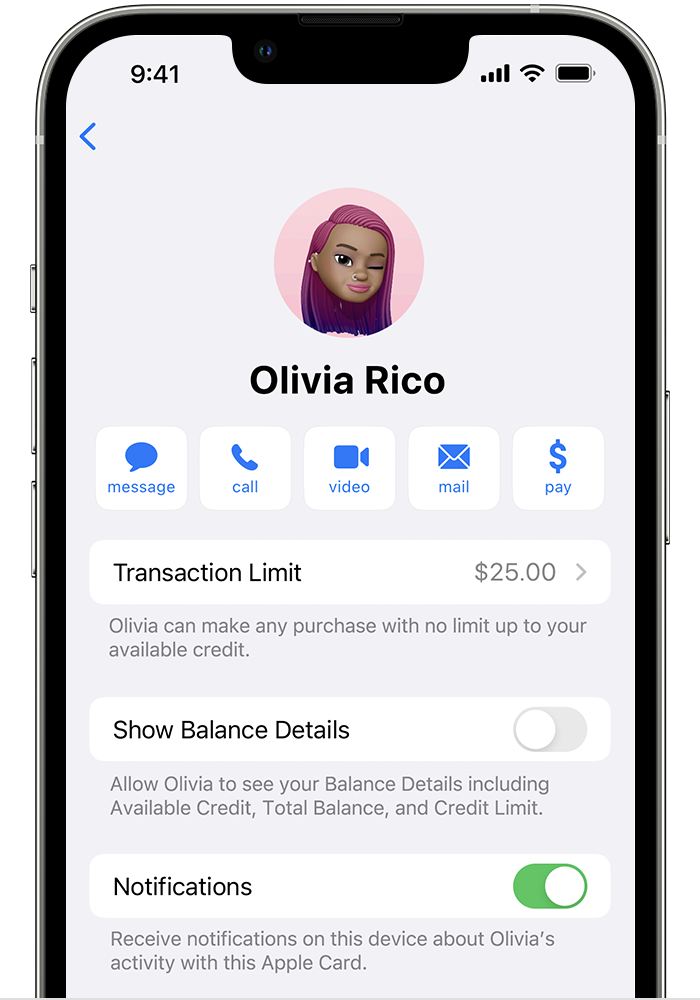

Set spending limits and get notifications for Apple Card Family participants

Account owners and co-owners can set spending limits for participants on their shared Apple Card account.1 They can also get notifications on an account co-owner or participant's Apple Card activity.2

How to set spending limits for Apple Card Family participants

On your iPhone, open the Wallet app and tap Apple Card.

Tap the , then tap .

Tap the name of the participant that you want to set limits for.

Tap Transaction Limit.

Tap the amount that you want to set.

When a spending limit is set, the participant can't spend more than that amount on an individual transaction. They can still spend up to the credit limit on the shared Apple Card account with multiple purchases, as long as each purchase is below the transaction limit. The account owner or co-owner can also lock a participant's spending or remove the participant from the shared Apple Card account.

Turn on notifications for an Apple Card Family account co-owner or participant's activity

On your iPhone, open the Wallet app and tap Apple Card.

Tap the , then tap .

Tap the name of the participant or co-owner that you want to turn on transaction notifications for.

Under Notify Me About, tap Transactions or Total Spending and choose an amount.

If you choose Transactions, you receive notifications when an individual purchase exceeds the amount that you chose. If you choose Total Spending, you receive a notification when the user's cumulative monthly spending exceeds the amount that you chose.

Each co-owner is jointly and individually responsible for all balances on the co-owned Apple Card, including amounts due on your co-owner's account before the accounts are merged. Each co-owner will be reported to credit bureaus as an owner on the account. In addition, co-owners will have full visibility into all account activity and each co-owner is responsible for the other co-owner's instructions or requests. Credit reporting includes positive and negative payment history, credit utilization, and additional information. Card usage and payment history may impact each co-owner's credit score differently because each individual's credit history will include information that is unique to them. Addition of new co-owner or merging existing accounts is subject to credit approval and general eligibility requirements. Learn more about Apple Card eligibility requirements. Either co-owner can close the account at any time, which may have a negative credit impact. Both co-owners will still be responsible for paying all balances on the closed account. Learn more about account sharing options, including some of the risks and benefits.

Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch. Available for qualifying applicants in the United States. To access and use all of the features of Apple Card, add Apple Card to Wallet on your iPhone or iPad with the latest version of iOS or iPadOS.

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple assumes no responsibility with regard to the selection, performance, or use of third-party websites or products. Apple makes no representations regarding third-party website accuracy or reliability. Contact the vendor for additional information.