How to transfer money to your bank or eligible debit card

When you transfer money from your Apple Cash1 card, you can either use a bank transfer to send funds to your bank account in 1 to 3 days or you can use Instant Transfer2 to send funds instantly3 to an eligible Mastercard or Visa debit card.

You can also send money to an individual in Messages or Wallet.

Transfer instantly to an eligible debit card

First, make sure that your iPhone or iPad has the latest version of iOS or iPadOS and add an eligible debit card4 in the Wallet app.

Then, make an Instant Transfer:

- Go to your card info:

- On iPhone: open the Wallet app, tap your Apple Cash card, tap the More button

, then tap Transfer to Bank

, then tap Transfer to Bank  .

. - On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to Bank

.

.

- On iPhone: open the Wallet app, tap your Apple Cash card, tap the More button

- Enter an amount and tap Next.

- Tap Instant Transfer.

- If you haven't added an eligible debit card, tap Add Card and follow the instructions on your screen to add a Mastercard or Visa debit card.

- Tap Transfer. Then tap > to select the debit card that you want to transfer funds to and select the billing information for your chosen debit card.

Your funds should transfer within 30 minutes.

Transfer in 1 to 3 business days to a bank account

- Go to your card info:

- On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button

, then tap Transfer to Bank

, then tap Transfer to Bank  .5

.5 - On iPad: Open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to Bank

.

.

- On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button

- Enter an amount and tap Next.

- Tap 1-3 Business Days. If you don't have a bank account set up, follow the instructions on your screen to add one.

- Tap Transfer. Then confirm with Face ID, Touch ID, or passcode.

Your funds should transfer within 1 to 3 business days.

If you're under 18 years old and part of Apple Cash Family

Children less than 13 years old can transfer funds from their Apple Cash account to a bank account.1

Teens at least 13 years old can transfer funds to their bank account or an eligible debit card using Instant Transfer.

How to update your bank account information

- Go to your card info:

- On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button

, then tap Card Details

, then tap Card Details  .

. - On iPad: Open the Settings app, tap Wallet & Apple Pay, then tap your Apple Cash card.

- On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button

- Tap Bank Account, then tap the bank account you want to update.

- To delete your banking information, tap Delete Bank Account Information. Tap again to confirm. After deleting, you can add your bank information again or add different information.

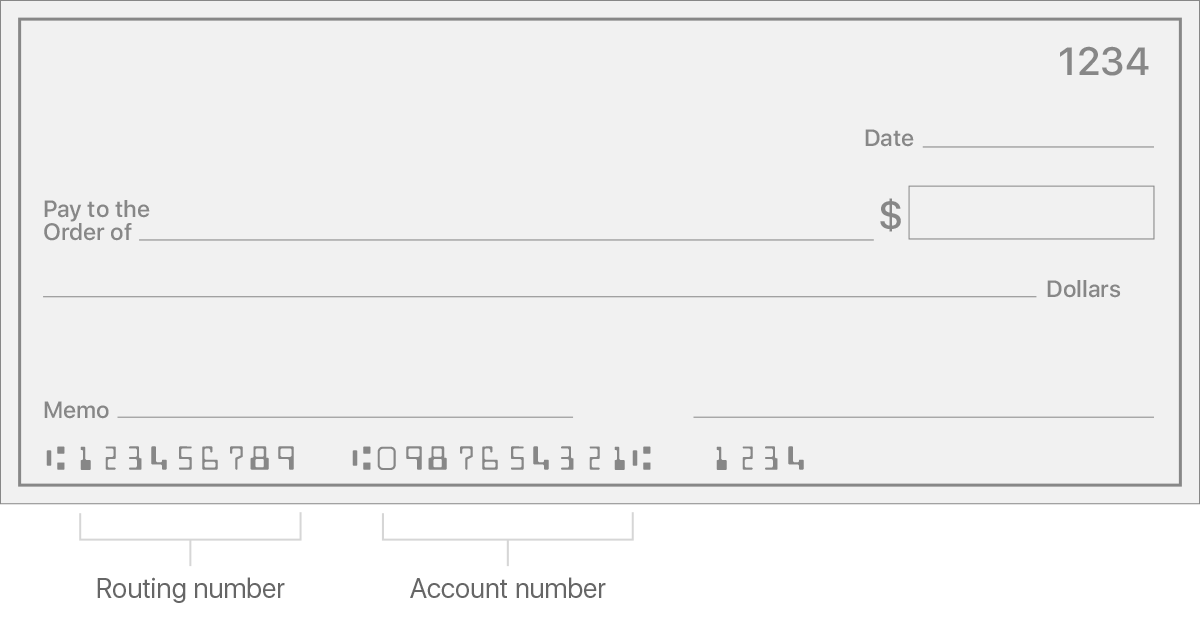

- To edit your bank information, tap next to your routing number or account number, add your information, then confirm the numbers and tap Next.6

When you update your information on one device, it automatically updates on all of the devices that are signed in with your Apple ID.

About transfer limits

You can transfer up to $10,000 per transfer and up to $20,000 within a seven-day period from Apple Cash to your bank account. You can only transfer your money to a bank account in the United States. There are no fees to transfer your money from Apple Cash to your bank account, unless you use an Instant Transfer.

Learn about account limits and person to person payment limits.

How to find your bank account number or routing number

Your bank account number and routing numbers are easy to find on your checks. If you don't have a check, you can call your bank and ask for this information.

If you didn't receive your transfer

Check your bank statement to see if the transfer has been processed and deposited into your bank account. Bank transfers aren't deposited on bank holidays or the weekend. See holidays observed by the Federal Reserve on federalreserve.gov.

If you don't receive an Instant Transfer after 2 hours, or you don't receive a 1 to 3 business day transfer after 3 business days, contact Apple Support.

If you think that you entered the wrong bank account or routing number, contact Apple Support.

If you can't transfer money

- Check for iOS, iPadOS, or watchOS updates.

- Make sure that your device is eligible to use with Apple Pay.

- Make sure that you have a Wi-Fi or cellular connection.

- If you're transferring money to a debit card, make sure that it's an eligible debit card.

After each step, try to transfer money again:

- For 1 to 3 business day transactions, make sure that you added an eligible United States bank account and that you entered the correct account and routing numbers. If you enter the wrong numbers, the transfer might go to the wrong account.

- Instant Transfers require you to use the billing address that matches your selected debit card.

- Check the limits. The minimum amount that you can transfer to your bank account is $1. If your balance is less than $1, you can transfer your total balance as an exception to the minimum. The maximum amount that you can transfer per transaction is $10,000.

- Make sure you aren't using accents when you enter your name.

If you still can't transfer money to your bank, you might need to verify your identity.

- You must be at least 18 years old and a resident of the United States to use Apple Cash services, unless you're part of Apple Cash Family. These services are provided by Green Dot Bank, Member FDIC. Learn more about the Terms and Conditions.

- A 1.5 percent fee (with a minimum fee of $0.25 and a maximum fee of $15) is deducted from the amount of each Instant Transfer.

- Account security checks may require additional time to make funds available. Instant Transfers typically post immediately but can take up to 30 minutes.

- Only eligible for debit cards issued in the United States. If you aren't sure whether your card is eligible, contact your card issuer.

- When you aren't using Instant Transfer, there are no fees to transfer your money from Apple Cash to your bank account.

- Enter your bank information carefully. If you enter the wrong information, your money might go to the wrong account and may not be able to be recovered. If you need help, contact Apple Support.